Ian Ippolito, Founder & CEO of Private Investor Club talks about how distribution payments were handled before Verivend.

Ian Ippolito, Founder & CEO of Private Investor Club talks about how distribution payments were handled before Verivend.

Ian Ippolito, Founder & CEO of Private Investor Club talks about how much time he and his team have saved with Verivend.

Ian Ippolito, Founder & CEO of Private Investor Club talks about how Verivend has seamlessly integrated into his fund administration.

Ian Ippolito, Founder & CEO of Private Investor Club talks about the feedback he’s received from his investors about Verivend.

Your Preferred Return has arrived.

In this issue, we talk about wire fraud and the scams plaguing investment transactions, cap calls (and why they may be crap calls 💩), and the changing preferences of limited partners.

Scammers Target Wall Street in New Capital Call Fraud Schemes

by Agari

Capital Call Investment scams are the newest form of fraud that scammers are using to swindle Wall Street firms and their clients out of an average of $800,000 per incident.

Why does this matter?

⬆️ The number of wire transfers continues to increase year-over-year with 196 million wire transfers originated in 2022 reported by The Federal Reserve — that’s over 784,000 wire transfers per day!

✉️ BEC (Business Email Compromise) attacks doubled in 2022 and surpassed ransomware attacks according to Computer Weekly and data compiled from hundreds of incidents responded to by the Secureworks Counter Threat Unit (CTU).

🤯 The average payout targeted in capital call schemes is $809,000.

Therefore, it’s never been more important for firms to protect themselves, their capital, and their investors.

Capital Call Problems Solved

Do you have a capital call problem? Most do and don’t even know it. 💩

Creating, verifying, sending, managing, and reconciling capital calls is a painful process for Private Equity, Venture Capital, and all types of Investment Sponsors.

The current process wastes time, requires manual effort, and imposes unnecessary risks for both Investment Sponsors and their Investors.

How can you flush your capital call problems with Verivend? 🚽

⏱️ Create and send all your capital calls in seconds, not hours or days.

🔒 Protect your capital and investors through a secured, end-to-end encrypted platform and eliminate unnecessary risks, Business Email Compromise, and wire fraud.

📱 Give your investors a frictionless, “Amazon-like” one-click experience to securely fund all their investments.

👀 Watch how you can send 60 capital calls in just 60 seconds with Verivend:

Investor Preferences are Changing

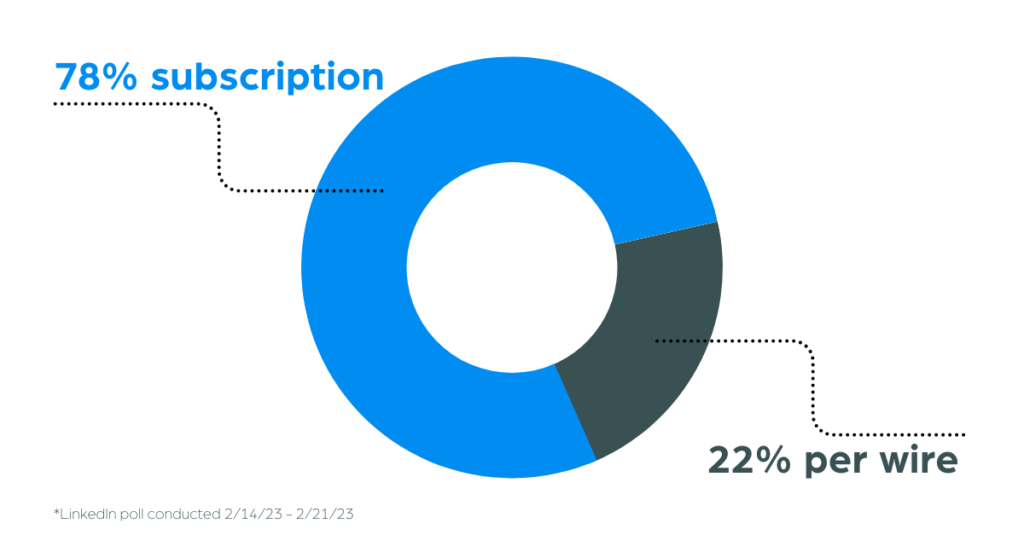

In a recent LinkedIn poll, we asked LPs “Would you prefer to pay per wire or a monthly subscription of $10 regardless of the number of wires sent?”

78% of LPs said that they would prefer to pay a monthly subscription, while only 22% said they prefer to pay per wire.

These results highlight several key insights into the evolution of LP preferences and expectations:

⚡️ LPs expect more “Amazon-like” experiences that are fast, responsive, and frictionless.

👍 There’s an appetite for LPs to pay for these better and more efficient experiences, which shifts costs away from GPs.

👀 GPs should be actively looking for technology that automates their back office while improving their investors’ experience.

The Transient Era of Billion-Dollar Funds

by PitchBook

While the fundraising climate has cooled to some degree, a number of interesting developments have materialized over the last few years.

Why does this matter?

⬇️ The number of billion-dollar funds is decreasing

⬆️ LP demand in the private markets is increasing

⬅️ Investments are shifting from later-stage deals to earlier-stage deals

🔁 Smaller fund sizes + investments into earlier-stage deals = less larger GPs and more smaller LPs

🔀 More demand + more LPs = more pain & effort for GPs 😖

Therefore, it’s never been more critical for firms to be automating processes, increasing efficiencies, and enhancing LP experiences.

The investment journey just got better with Verivend ✍️

We’re thrilled to announce the release of Verivend Digital Signatures to our robust suite of features.

With Verivend’s digital signature functionality, GPs can now easily create and send subscription documents and other agreements to LPs for review and signing, all within the platform. The digital signature functionality streamlines the entire signature process, reducing delays and increasing efficiency for private capital transactions.

Verivend Digital Signatures are available now to all existing and new customers.

How are you managing your capital raising activities?

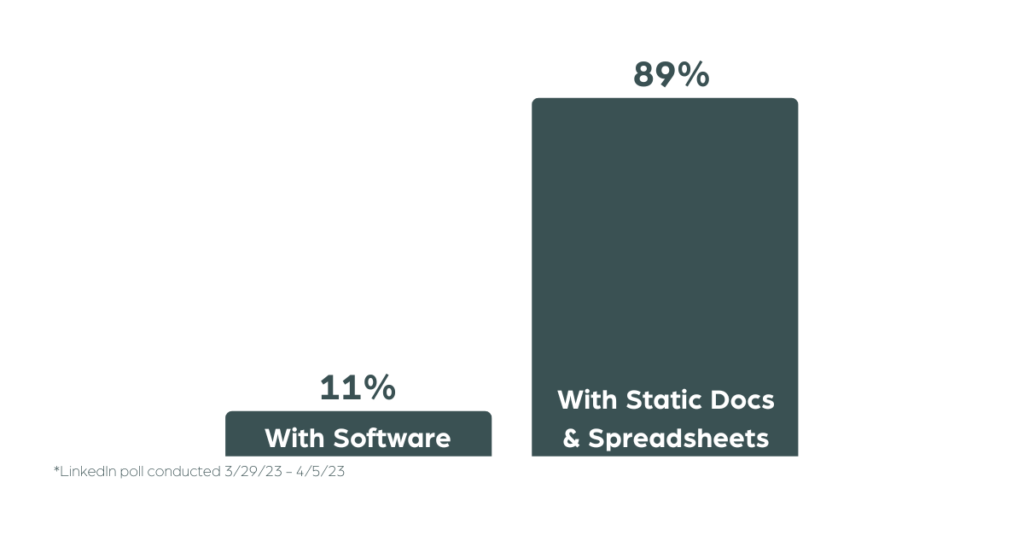

In a recent LinkedIn poll, we asked GPs “How are you managing your capital raising activities?”

89% said they’re managing with static documents and spreadsheets, which points to significant inefficiencies in the private capital industry.

Do you want to be part of the 89% of firms that are lagging or part of the forward-thinkers that are focused on:

⏱️ Efficiency

🔒 Security

😍 LP Experience

Have 5 minutes?

That’s all it takes for GPs, Fund Managers, and Investment Sponsors to get started with Verivend.

Watch CEO & Co-Founder Rodney Reisdorf walk through the entire end-to-end process in just under 8 minutes, with a total setup time of only 5 minutes for a GP, Fund Manager, or Investment Sponsor to start raising capital without pain, effort, or paper.

Learn more and schedule a demo today at verivend.com/demo

FOR IMMEDIATE RELEASE

April 11, 2023 – Buffalo, NY – Verivend, the trusted payments platform for private capital transactions, is proud to announce the addition of digital signature functionality to its robust suite of features. This new enhancement allows General Partners (GPs) to efficiently manage signature requests for subscription documents and other agreements with their Limited Partners (LPs), making the transaction process even easier and more efficient.

With Verivend’s digital signature functionality, GPs can now easily create and send subscription documents and other agreements to LPs for review and signing, all within the platform. LPs can then securely sign and return the documents electronically, eliminating the need for time-consuming and cumbersome manual signatures. The digital signature functionality streamlines the entire signature process, reducing delays and increasing efficiency for private capital transactions.

“We are thrilled to introduce digital signature functionality to our payments platform,” said Rodney Reisdorf, CEO of Verivend. “Our goal is to provide our customers with the most advanced and user-friendly tools to manage their private capital transactions. With digital signature capabilities, GPs can now seamlessly manage more of the investment journey, resulting in faster and smoother transactions with their LPs.”

Verivend is known for its commitment to providing secure and reliable payment solutions for private capital transactions. The addition of digital signature functionality further enhances Verivend’s reputation as a leading platform for GPs and LPs seeking an efficient and secure way to manage their subscription documents and agreements.

Key benefits of Verivend’s digital signature functionality include:

Verivend’s digital signature functionality is now available to all existing and new customers. To learn more about Verivend’s payments platform and its latest features, please visit www.verivend.com.

About Verivend

Verivend is the leading payments platform for private capital transactions, providing a secure and efficient way for General Partners (GPs) and Limited Partners (LPs) to manage subscription documents and other agreements. With innovative features and robust security measures, Verivend is trusted by private capital professionals worldwide for its reliable and user-friendly payment solutions. For more information, visit www.verivend.com.

Media Contact:

info@verivend.com

+1 716-259-1044

Note to editors: Images and additional information are available upon request.

Q: What makes Verivend different for investment sponsors?

A: Verivend is the only payment-first platform for private capital that allows GPs and LPs to transact with the same ease, efficiency, and security that individuals have enjoyed in their personal lives with apps like Venmo and PayPal. With Verivend, the effort, pain, and security risks of raising and deploying capital are eliminated, which saves GPs and LPs countless hours and provides both with a superior pain-free experience.

Q: How do Digital Signatures with Verivend provide value to investment sponsors and their LPs?

A: The typical process for investment sponsors to manage and collect signatures on subscription agreements and other legal documents from investors is to manually email those documents and have LPs sign them and email them back, or to use another platform that needs to be managed separately. This provides a sub-optimal experience for both GPs and LPs since various parts of the investment journey live in different platforms, which results in a disconnected experience.

With Verivend Digital Signatures, GPs can send out documents for all LPs to sign in a matter of seconds, and LPs digitally sign those documents in just a few clicks within their secure investor portal. This provides a superior pain-free experience for both GPs and LPs to now manage more of the investment journey all within the Verivend platform.

Q: How secure is Verivend?

A: Verivend prioritizes security and takes extensive measures to protect sensitive financial information. Our platform uses state-of-the-art encryption and data protection technologies to ensure that all data is securely transmitted and stored. We also comply with all relevant regulations and standards, such as PCI DSS, to ensure the security and confidentiality of financial information. In addition, we regularly monitor our systems for any potential security threats and vulnerabilities and have protocols in place to respond quickly to any security incidents.

Q: How long does it take for an investment sponsor to start using Verivend?

A: Verivend’s time to value for investment sponsors is almost immediate. Verivend requires no painful implementation or lengthy customization, and it takes only minutes for investment sponsors to get set up and start using Verivend. Many GPs have signed up, sent out their first capital calls, and started to see them funded by their LPs all within a matter of hours.

Q: What do investors need to do to start using Verivend?

A: The Verivend investor experience has been purposefully designed to be completely frictionless. With just one click, investors immediately access their secure portal where they view and act on any items received from investment sponsors. This includes Commitments, Signatures, Capital Calls, Distributions, and Rooms. This provides investors with an all-inclusive and comprehensive experience to manage their investment journey with one, or as many investment sponsors as they’re associated with using Verivend.

Does your process for managing commitments with your investors include multiple phone calls, disjointed documentation, manual processes, follow-up, and uncertainty…all to end up with a static spreadsheet of investment commitments?

Ditch the spreadsheets and manual effort with managing investment commitments.

Read on to see how Verivend provides a seamless process for investment sponsors to manage commitment requests, and a frictionless experience for investors to confirm and fund their investments.

Verivend was created as a secure payment platform for investment sponsors to automate their capital call funding and distribution payments, and in the past few days we’ve seen customers move not only their funds, but their deposits, to their Verivend digital wallets in order to ensure continued access to their operating capital.

Why GPs and fund managers are moving their capital to Verivend:

Verivend is experienced and well-positioned to support and secure venture, angel, and private equity investments, with hundreds of millions of dollars flawlessly moved over tens of thousands of transactions between general partners, limited partners and investors, and their administrators.

Verivend’s payment-first fund administration platform eliminates the effort, pain, and security risks for investment sponsors and their investors and allows the raising and deployment of funding in a secure, transparent environment.

Getting started with Verivend is completed in a matter of minutes with an efficient, electronic, and integrated account opening process and investment sponsors can start moving money through Verivend after completing a same-day KYC process.

Unlock more security for your funding and operating capital by scheduling your demo today at https://verivend.com/demo