August 23, 2023 – Issue 4

Your Preferred Return has arrived.

As summer winds down and back-to-school season is upon us, we’re excited to be delivering the latest issue of The Preferred Return, brought to you by Verivend.

In this issue, it’s all about going back to school with fundraising tips for first-time fund managers, what ROI looks like after GPs eliminate the pain and effort of managing a fund, and what VC Firms are focusing on for the rest of 2023.

Industry Insights

How First-Time Fund Managers Can Gain Fundraising Edge

by PitchBook

Fundraising in the private equity industry follows a familiar tale: Bulge bracket investment firms enjoy easy access to capital, while first-time fundraisers typically find it challenging to hit their targets.

Exceptions do exist, though.

So how can first-time fund managers gain a fundraising edge?

💰 During Q1 2023, emerging fund managers accounted for only 15% of all capital raised, while the other 85% was raised by experienced fund managers.

🧠 Experience and track record are common strengths among emerging GPs.

👯♀️ Co-investment opportunities allow GPs to enhance existing LP relationships and forge new connections.

🔬 Investors can be more attracted to specialist managers with unique expertise or a sector focus compared with generalists.

ROI Realized

Hear how GPs describe the ROI they’ve realized with Verivend that’s saved them time, eliminated manual processes, and unlocked the ability to focus on the core value proposition of their businesses.

Industry Insights

What’s Most Important to VC Firms in H2 2023?

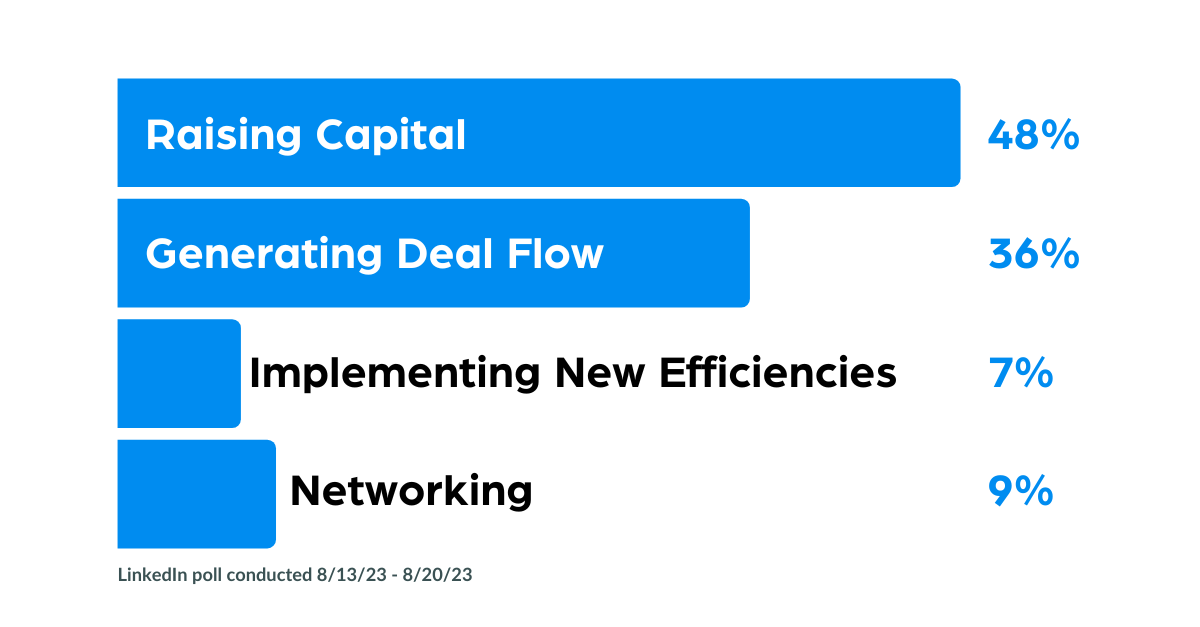

In a recent LinkedIn poll, we asked VC Firms “Which of the following is most important to you for the rest of 2023?”

The majority of VC firms are focused on raising capital (48%) and generating deal flow (36%) for the rest of 2023.

While the VC fundraising climate was noticeably cooler earlier this year, these results point to a warming trend for the second half of 2023.

With both capital raising and dealflow efforts coming back into focus, it’s reassuring to see the rebound of VC begin, indicating an optimistic start to 2024.