Andrew Hennessy, Managing Partner at Ilion Capital Partners talks about how he would describe Verivend and how it’s evolved into a one-stop shop for how they communicate with their investors.

Andrew Hennessy, Managing Partner at Ilion Capital Partners talks about how he would describe Verivend and how it’s evolved into a one-stop shop for how they communicate with their investors.

Andrew Hennessy, Managing Partner at Ilion Capital Partners talks about how they used to manage raising and calling capital before Verivend.

Andrew Hennessy, Managing Partner at Ilion Capital Partners talks about the time they’ve been able to save with Verivend.

Andrew Hennessy, Managing Partner at Ilion Capital Partners talks about the feedback he’s received from his investors about Verivend.

Your Preferred Return has arrived.

Welcome to the latest Preferred Return by Verivend. In this issue, we talk about SPV innovation and why it’s time to challenge the rigidity of the traditional investment lifecycle, what our customers’ lives were like before Verivend, and how much capital is being raised in the current economic climate.

Announcing a Massive Evolution in SPV Investing

by Ari Newman, Managing Director at Massive

After three years of deploying capital via SPVs at Massive, MDs Ari Newman and David Mandell wanted to reduce the friction points of deal-by-deal investing while maintaining the flexibility of the SPV structure. The Massive Index was born and is a new SPV-based committed capital vehicle where an investor can subscribe to the next 10 or 20 investments, or on a deal-by-deal basis.

Why does this matter?

✅ Investors can subscribe at any time without a fixed window of time like a traditional fund.

➕ Investors can “plus up” their baseline commitment amounts per investment.

💪 Flexibility of investing allows investors to subscribe to the next 10 or 20 investments and renew, or exit as appropriate.

💸 Investments are funded via quarterly capital calls like traditional funds.

🚫 Too many K1s? The Massive Index alleviates this point of friction with SPVs.

Massive is now accepting new subscribers but space is limited so if the Massive Index is interesting and you’d like to learn more, reach out here.

One of our favorite things is to hear from our customers about the contrast between what their lives were like before and after Verivend.

Hear each of them describe how their lives were changed by Verivend in less than 60 seconds, and check out the rest of Verivend’s Customer Stories below.

Ian Ippolito, Founder & CEO of Private Investor Club

Sam Russo, Partner & Managing Director at Lorraine Capital

Ryan Kagels, CFO at Counsel Financial

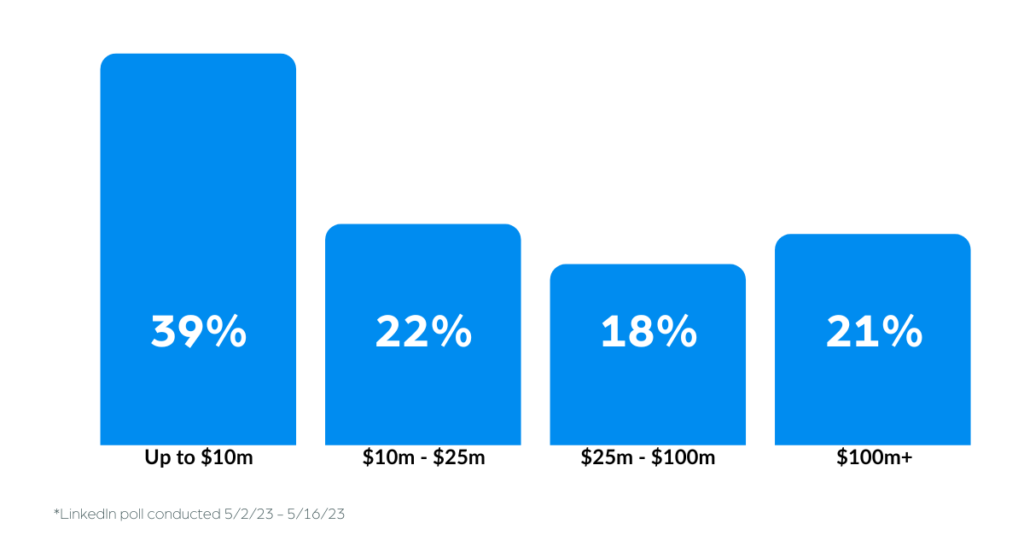

Raising Capital & How Much?

In a recent LinkedIn poll, we asked investment sponsors and founders “How much capital are you raising?”

39% of GPs and founders said they’re planning to raise up to $10m, with the rest of respondents nearly equal across the remaining categories of $10m to over $100m.

These results indicate that although there’s been a cooldown in the capital raising market and volumes have been pushed to smaller sizes, there is still a strong demand for fueling growth in the industry.

Ian Ippolito, Founder & CEO of Private Investor Club talks about his group of over 6,000 investors that provides a better way for investors to find good deals, leverages a deep network of due diligence expertise, and brings significant benefits to investment sponsors for win-win outcomes.

Ian Ippolito, Founder & CEO of Private Investor Club talks about what life was like before Verivend.

Ian Ippolito, Founder & CEO of Private Investor Club talks about the easy onboarding process with Verivend.

Ian Ippolito, Founder & CEO of Private Investor Club talks about how he describes Verivend.

Ian Ippolito, Founder & CEO of Private Investor Club talks about capital calls were handled before Verivend.